A. Consumer Protections

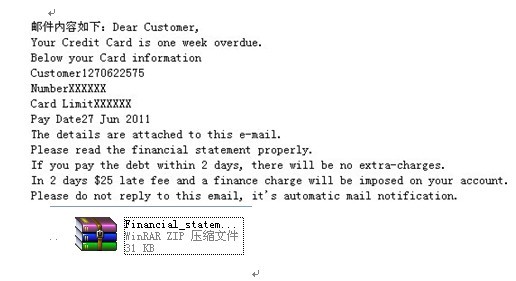

- Credit Cards (U.S.): The Credit CARD Act of 2009 caps late fees at a "reasonable" amount, usually around 41 for subsequent violations.

- Rent Payments: Many states limit late fees (e.g., California restricts them to 5% of the monthly rent).

B. Business-to-Business (B2B) Contracts

- Late fees in commercial agreements are often negotiable.

- Some industries impose statutory interest (e.g., 1.5% per month on overdue invoices in certain jurisdictions).

Pro Tip: Always review contracts before signing—some lenders may include excessive late fees that can be negotiated down.

🔹 Jane Mitchell, Credit Counselor

"Many consumers underestimate how much late fees add up over time. A 420 a year—money that could be better spent paying down debt."

🔹 Mark Reynolds, Commercial Loan Officer

"Businesses should enforce late fees fairly but firmly. Too lenient, and cash flow suffers; too harsh, and you risk losing clients."

🔹 Sarah Chen, Personal Finance Blogger

"The best defense against late fees is budgeting. Apps like YNAB or Mint can help track due dates and avoid missed payments."

1. What Are Late Payment Fees?

Late payment fees are financial penalties assessed when a payment is not received by the agreed-upon deadline. They serve two primary purposes:

3. The Hidden Costs of Late Payments

Beyond the immediate fee, late payments can trigger a domino effect of financial consequences:

5. Expert Opinions: What Industry Insiders Say

To provide deeper insights, we gathered perspectives from financial experts:

Final Thoughts

Late payment fees are more than just a nuisance—they can derail financial stability if ignored. By understanding how they work, staying organized, and leveraging technology, both consumers and businesses can minimize unnecessary penalties.

📌 Want more financial tips? Subscribe for weekly insights on managing debt, improving credit, and avoiding hidden fees!

Have you ever been hit with an unexpected late fee? Share your experiences in the comments!

This article explores the intricacies of late payment fees, their legal implications, and strategies to avoid them. Whether youre a business owner enforcing payment policies or a consumer trying to navigate financial obligations, understanding how these fees work is crucial.

✅ Automate Payments: Set up autopay for recurring bills.

✅ Payment Reminders: Use calendar alerts or banking apps to track due dates.

✅ Negotiate Extensions: If facing financial hardship, contact creditors to request a grace period.

✅ Prioritize High-Impact Bills: Mortgages, car loans, and credit cards should take precedence over less critical expenses.

- Compensation for the Creditor: The fee helps offset administrative costs and potential losses due to delayed payments.

- Incentive for Timely Payments: By imposing penalties, creditors encourage borrowers to pay on time.

These fees vary depending on the type of agreement:

- Credit Cards: Typically range from 40 per late payment.

- Loans & Mortgages: May include a percentage of the overdue amount (e.g., 5% of the unpaid balance).

- Rent & Utilities: Often a flat fee (e.g., $50) or a percentage of the rent.

2. Legal Regulations Surrounding Late Fees

Not all late fees are created equal—some are strictly regulated, while others are left to contractual agreements.

- Credit Score Damage: A single late payment can drop your credit score by 100+ points, making future loans more expensive.

- Increased Interest Rates: Some lenders apply penalty APRs (Annual Percentage Rates) after repeated late payments.

- Legal Action: Persistent non-payment may lead to collections, lawsuits, or even eviction (for renters).

4. How to Avoid Late Payment Fees

Preventing late fees requires proactive financial management. Here are some proven strategies:

Understanding Late Payment Fees: A Comprehensive Guide to Avoiding Financial Penalties

Late payment fees—often referred to as "late fees" or "delayed payment penalties"—are charges imposed when a borrower or consumer fails to make a payment by the due date. These fees can apply to various financial obligations, including credit cards, loans, rent, utilities, and subscription services. While they may seem like a minor inconvenience at first, repeated late payments can lead to significant financial strain, damage to credit scores, and even legal consequences.

相关问答